Child Tax Credit

The 2021 Expanded Child Tax Credit

The Child Tax Credit (CTC) was created as a tax benefit to help families who are raising children. The 2021 expanded and improved Child Tax Credit was included in the American Rescue Plan Act which became law March 11, 2021. Based on our American Family Act, I co-authored the expansion bill with Representatives Suzan DelBene and Ritchie Torres to help families afford basic needs like purchasing food and covering house expenses, including mortgage, rent, or utilities payments.

A Year After Expansion

The 2021 Expanded and Improved Child Tax Credit helped the families of 61 million children in the United States. In 2021…

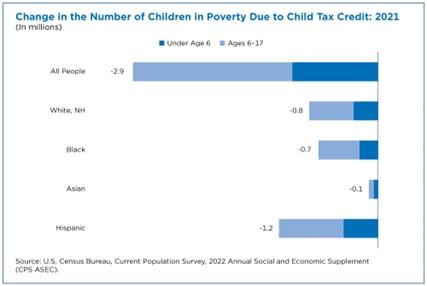

- Nearly 4 million children were lifted out of poverty

- The overall child poverty rate fell from 9.7 percent to 5.2 percent -- a 46 percent decline from 2020

- The Asian child poverty rate fell from 6.7 percent to 5.1 percent; the Black child poverty rate fell from 16.9 percent to 8.1 percent; the Hispanic child poverty rate fell from 14.7 percent to 8.4 percent; and the White child poverty rate fell from 5.7 percent to 2.7 percent.

- Food insufficiency decreased by 26% among low-income households following the monthly payments.

When children and families receive these tax credits, they will learn more, earn more, and grow up healthier and less likely to end up incarcerated. Scholars at Columbia University found that a permanently expanded Child Tax Credit would return $8 for every $1 and taxpayers would actually earn back 84 cents for every dollar invested. How? The evidence shows:

- Children will learn more and earn more later in life, leading to increases in tax payments.

- Children are less likely to be neglected, leading to decreases in child protection costs.

- Children are less likely to end up participating in criminal activity, leading to savings in costs of law enforcement.

- Children are likely to be healthier, leading to decreased health care costs.

- Even the parents of children are likely to be healthier, leading to further decreases in health care costs (in fact, scholars have found that such a policy leads to reductions in drinking and smoking among parents of recipients).

Moving Forward

A year after the expanded monthly CTC was allowed to lapse, families are hurting because of the rising cost of essentials like food, gas, housing, and utilities. I believe the Child Tax Credit was the most effective tool we had in the fight against rising costs, and recent Census Bureau data demonstrates the payments had a profound impact, leading to child poverty falling nearly in half in a single year – the largest decrease on record. I have never seen a federal program have as immediate of an impact as the Child Tax Credit.

That is why I am fighting to extend the expanded monthly Child Tax Credit in a year end package. It’s time to deal working- and middle-class families back in.

The American Family Act

The American Family Act would expand and improve the CTC based on the latest research about what works to improve outcomes for children. According to estimates from Columbia University, the CTC now lifts approximately one-sixth of all previously poor children above the poverty line. However, one-third of all children do not have access to the full benefit because they are in families who earn too little to get the full CTC. This group disproportionately includes larger families, rural families, military families, and families with young children.

The bill is estimated to cut child poverty by nearly 45%, cut Asian American & Pacific Islander child poverty by 37.0%, cut Black child poverty by 52.4%, cut Hispanic child poverty by 45.4%, cut Native American child poverty by 61.5%, and cut white child poverty by 38.6%. In addition to drastically cutting child poverty, the American Family Act provides middle class families with additional help as well.

Specifically, the legislation would:

- Increase the Maximum Child Tax Credit and Pay Benefits Monthly for All Children under 17. The bill would expand the CTC to $250 per month ($3,000 per year) for children 6 years of age or older and $300 per month ($3,600 per year) for children under 6, up from the current maximum of $2,000 per year.

- Make Credit Fully Refundable. The bill would make the CTC fully refundable, meaning that all low-income families would receive the full credit for each child. The current CTC only begins to phase-in after a taxpayer has earned $2,500 of income and at a rate of 15 cents for every dollar of additional income. In addition, only $1,400 of the $2,000 credit is refundable.

- Benefit the Middle Class. The bill would provide a tax credit for all individuals with children who earn less than $150,000 per year and all married couples with children who earn less than $200,000 per year.

- Index the Credit for Inflation. The bill would index the credit to inflation (rounding to the nearest $50) to preserve the value of the credit going forward. The current CTC is not indexed for inflation.

Share Child Tax Credit Resources:

FACT SHEET: The Expanded and Improved Child tax Credit in 2021